EPFO Login – EPF Passbook, UAN Login, EPF Balance Check & Online Claim

The Employees' Provident Fund Organisation (EPFO), established in 1952 by India's Ministry of Labour and Employment, offers social security benefits like pension plans, insurance schemes, and provident funds to Indian employees, both male and female, across various non-government organizations.

What is the EPFO?

Established in 1952 by the Ministry of Labour and Employment, the EPFO functions as an autonomous body. Its primary objective is to provide financial security to employees after retirement. This is achieved through the Employees' Provident Fund (EPF) scheme, a mandatory contribution-based program for eligible employees.

Understanding EPF and UAN

The EPF scheme mandates contributions from both employers and employees towards a designated provident fund account. These contributions accumulate over the employment period, forming a retirement corpus for the employee.

The Universal Account Number (UAN) acts as a unique identifier for each EPFO member. It simplifies the management of provident fund accounts, especially for individuals who switch jobs frequently. Your UAN remains constant, regardless of any employment changes, streamlining the transfer of provident fund balances between employers.

Accessing Your EPFO Account

To access your EPFO account online, you'll need your UAN and password. You can log in through the official EPFO Member Portal:

Once logged in, you can view your EPF balance, track contributions, update your profile information, and even initiate claims for various EPFO schemes.

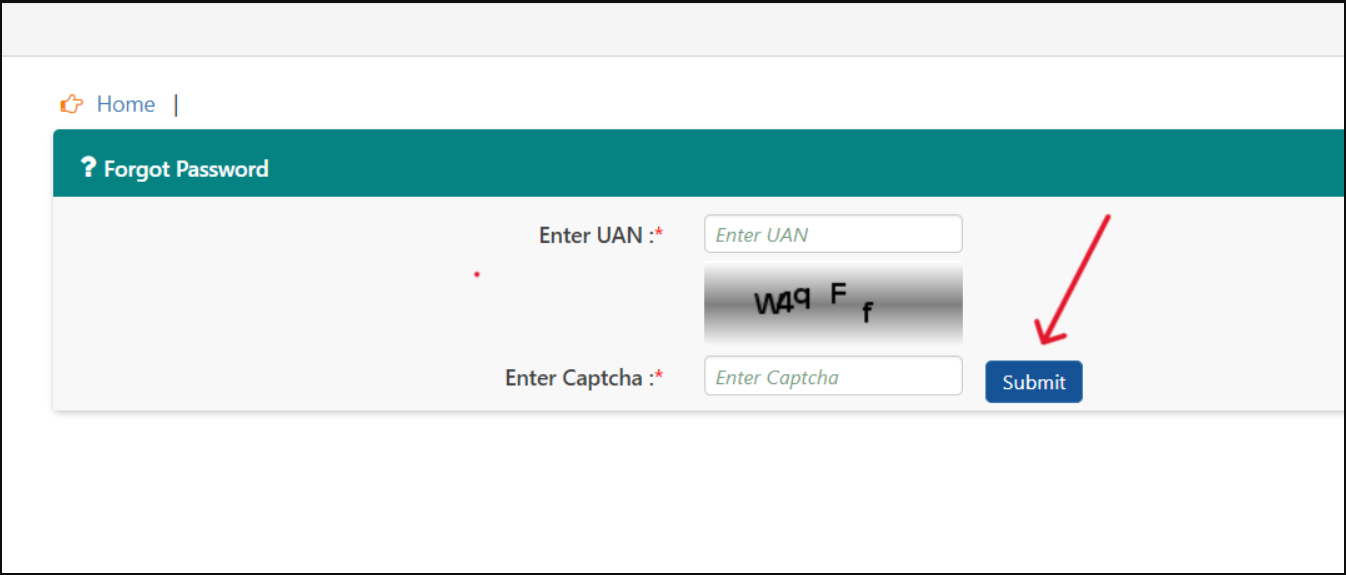

UAN Login: A Simplified Process

If you haven't activated your UAN yet, here's a quick guide:

- Visit the UAN activation page:

- Enter your basic details, including your PAN, Aadhaar number, and registered mobile number.

- Once you provide the necessary information, an OTP will be sent to your registered mobile number.

- Enter the OTP to validate your details and activate your UAN.

With your activated UAN and password, you can now access your EPFO account online and leverage its various services.

Additional Resources

For further assistance or information about the EPFO and its schemes, you can refer to the following resources:

- EPFO official website: https://www.epfindia.gov.in/

- UAN Helpdesk:

- EPFO mobile app (UMANG): Available on both Android and iOS platforms.

Remember, staying informed about your EPF contributions and account details is crucial for securing your financial future. By understanding EPFO Login, UAN Login, and other key aspects, you can effectively manage your provident fund and leverage its benefits for a secure retirement.

Frequently Asked Questions

Founded in 1952 by the Ministry of Labour and Employment, the Employees' Provident Fund Organisation (EPFO) safeguards the financial future of Indian workers by administering crucial social security schemes. Operating within the non-government and unorganized sectors, EPFO manages the Employees' Provident Fund (EPF) scheme, providing retirement benefits, pension plans, and various insurance schemes to millions of employees.

The Universal Account Number (UAN), a unique 12-digit identifier assigned by the Employees' Provident Fund Organisation (EPFO), serves as your passport to a secure financial future. Imagine it as a master key that unlocks a treasure trove of EPFO services, empowering you to manage your provident fund with ease.

Curious about your EPF balance? Skip the legwork and check it online in minutes! Simply head to the EPF Member Passbook page and log in with your UAN and password. It's that easy! Within seconds, you'll have clear insight into your retirement savings, empowering you to plan for the future with confidence.

Need a helping hand navigating the EPFO Member Portal or resolving account-related concerns? Look no further than the dedicated EPFO Helpline! Simply dial the toll-free number 1800118005, and a knowledgeable representative will be happy to guide you through your specific issue. Remember, seeking assistance is key to ensuring a seamless and stress-free experience managing your provident fund.